To streamline payment processing and enhance financial transactions, integrating the Payoneer API into your platform is a powerful solution. Payoneer API allows businesses to facilitate payments easily and securely, leveraging the power of APIs and web services. By connecting your system with the Payoneer API, you can automate payment workflows, track transactions, and provide a seamless experience for your users. This guide will walk you through the steps of integrating and utilizing the Payoneer API for efficient payment processing, leveraging the capabilities of APIs and web services to optimize your financial operations.

The Payoneer API is a powerful tool that allows developers to integrate payment processing capabilities into their applications. Using the Payoneer API enables businesses to manage cross-border payments efficiently, making it an essential component for e-commerce platforms and freelancers. In this article, we will explore how to implement the Payoneer API for your payment processing needs.

Understanding the Payoneer API

The Payoneer API provides a series of endpoints that allow developers to interact with Payoneer services programmatically. This includes functionalities such as creating payments, retrieving transaction details, and managing account settings. It supports various methods for integration, including RESTful web services, which makes it suitable for a wide range of applications.

Why Use the Payoneer API?

Here are some compelling reasons to use the Payoneer API for payment processing:

- Global Reach: Payoneer offers services in numerous countries, making it easier to send and receive payments internationally.

- Multi-Currency Support: The API allows for transactions in multiple currencies, which is ideal for businesses operating globally.

- Robust Security: Payoneer’s API is built with advanced security measures to protect sensitive payment data.

- Scalability: The API can support both small businesses and large enterprises as they grow.

Getting Started with the Payoneer API

Step 1: Create a Payoneer Account

Before you can use the Payoneer API, you need to have a valid Payoneer account. Visit the Payoneer website and sign up for an account. Ensure that your account is verified, as this is a requirement for accessing the API.

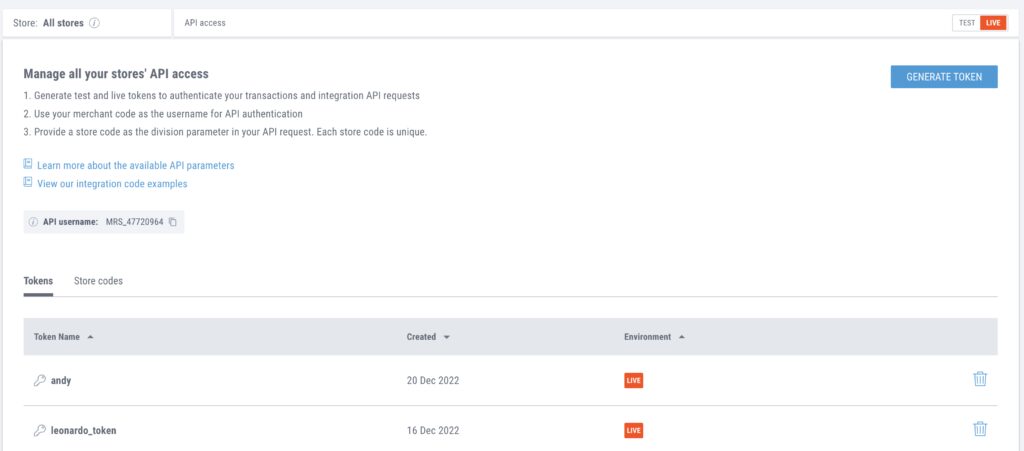

Step 2: Generate API Credentials

Once your Payoneer account is active, you will need to generate your API credentials. Follow these steps:

- Log in to your Payoneer account.

- Navigate to the API section in your account settings.

- Click on “Generate API Keys”.

- Make sure to store your API Key and API Secret securely, as these will be needed for authentication.

Step 3: Set Up Your Development Environment

To work with the Payoneer API, you will need a development environment set up for making HTTP requests. You can use programming languages such as Python, Java, or PHP. Below is a sample setup using Python.

Install the required libraries:

pip install requestsMaking API Calls

The Payoneer API uses REST architecture, meaning you will make HTTP requests to specific endpoints. Here’s how to perform common tasks:

Creating a Payment

To create a payment, you will need to make a POST request to the payment endpoint. Here’s a sample code snippet:

import requests

url = "https://api.payoneer.com/v4/payments"

headers = {

"Authorization": "Bearer YOUR_ACCESS_TOKEN",

"Content-Type": "application/json"

}

data = {

"amount": 100,

"currency": "USD",

"recipient": "recipient@example.com",

"description": "Payment for services"

}

response = requests.post(url, headers=headers, json=data)

if response.status_code == 200:

print("Payment created successfully:", response.json())

else:

print("Error creating payment:", response.text)Retrieving Payment Status

To check the status of a payment, use the GET request method:

payment_id = "YOUR_PAYMENT_ID"

url = f"https://api.payoneer.com/v4/payments/{payment_id}"

response = requests.get(url, headers=headers)

if response.status_code == 200:

print("Payment status:", response.json())

else:

print("Error retrieving payment status:", response.text)Managing Account Settings

Managing your account settings and preferences is crucial for optimal performance. You can update your account details by sending a PATCH request:

url = "https://api.payoneer.com/v4/accounts/YOUR_ACCOUNT_ID"

data = {

"businessName": "New Business Name",

"contactEmail": "newemail@example.com"

}

response = requests.patch(url, headers=headers, json=data)

if response.status_code == 200:

print("Account details updated successfully:", response.json())

else:

print("Error updating account details:", response.text)Error Handling

When working with APIs, it is essential to handle errors gracefully. The Payoneer API returns specific error codes that can help diagnose issues. Here are some common error responses:

- 401 Unauthorized: This indicates that your API credentials are invalid or expired.

- 400 Bad Request: This can occur if required parameters are missing or incorrectly formatted.

- 404 Not Found: You may be trying to access an endpoint that does not exist or a resource that is unavailable.

- 500 Internal Server Error: This suggests an issue on Payoneer’s side. It is best to retry after some time.

Best Practices for Using the Payoneer API

To maximize the effectiveness of the Payoneer API, consider the following best practices:

- Secure Your API Keys: Do not expose your API keys in public repositories and implement measures to protect them.

- Use Environment Variables: Store your API credentials in environment variables instead of hardcoding them into your application.

- Implement Retry Logic: Design your application to handle transient failures by implementing a retry mechanism for failed requests.

- Stay Updated: Regularly check the Payoneer API documentation for updates or changes to endpoints and functionalities.

Integrating Payoneer API with Other Services

The Payoneer API can be seamlessly integrated with various web services and APIs. For instance, you can connect it to a customer relationship management (CRM) system to automate invoice generation and payment tracking. Additionally, combining the Payoneer API with webhook services can enhance real-time notifications for payment statuses.

Integration with other APIs also allows for better data analytics. By leveraging analytics APIs, businesses can gain insights into transaction trends and payment behaviors, enabling more informed business decisions.

Conclusion

By utilizing the Payoneer API for payment processing, businesses can streamline their payment workflows, enhance customer experiences, and expand their global reach. Implementing the API may require some initial configuration, but the benefits that come with enhanced integration and automation can significantly boost operational efficiency.

Remember to follow best practices, handle errors gracefully, and stay informed on API updates for the best results in your payment processing endeavors.

Leveraging the Payoneer API for payment processing can streamline transactions and enhance efficiency in online businesses. By integrating this API into your platform, you enable secure and seamless payment processing for your customers, ultimately improving user experience and satisfaction. Embracing the power of APIs like Payoneer can enhance the functionality of your web service, leading to increased productivity and growth opportunities.